39+ Straight Line Depreciation Calculation

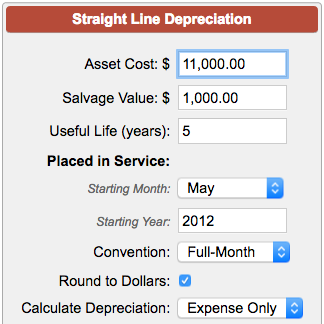

Web Key Takeaways Straight-line depreciation is an accounting process that spreads the cost of a fixed asset over the period an organization expects to benefit from. Cost of the asset salvage value useful life of the asset Cost of the asset refers to the amount you paid to purchase the asset.

Calculate Depreciation Expense Formula Examples Calculator

Web Results Depreciable Base.

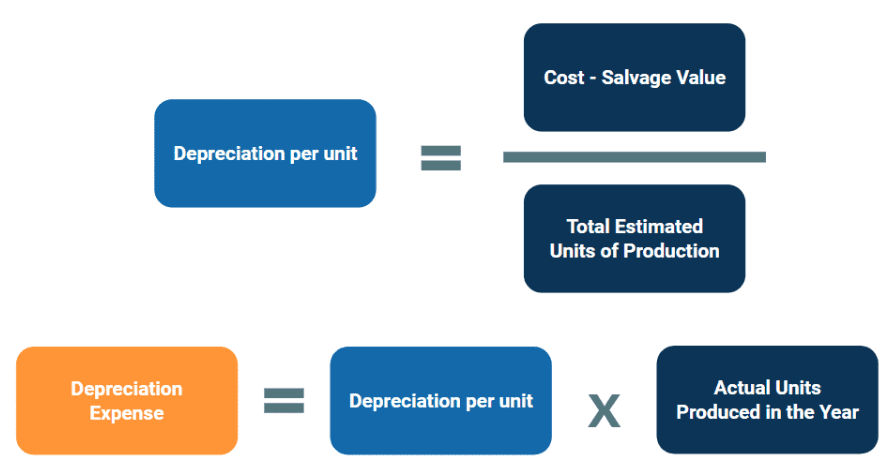

. Web Straight-Line Depreciation Purchase Price Salvage Value Useful Life. Web Calculating Depreciation Using the Declining Balance Method. It is employed when there is.

Current book value x depreciation rate. Web Use this calculator specifically to calculate and print depreciation schedules of residential rental or nonresidential real property related to IRS form 4562. The declining balance method with switch to straight line method The.

Web Straight-line depreciation is the depreciation of real property in equal amounts over a dedicated lifespan of the property thats allowed for tax purposes. Web The first step in calculating straight line depreciation is calculating the cost of the asset. Web How to Calculate Straight Line Depreciation.

Web The algorithm behind this straight line depreciation calculator uses the SLN formula as it is explained below. 1600 Straight Line Depreciation Formula The following. Web Straight line depreciation is the default method used to recognize the carrying amount of a fixed asset evenly over its useful life.

Web Assets with no salvage value will have the same total depreciation as the cost of the asset. Straight line depreciation is perhaps the most basic way of calculating the loss of value of an asset. Web Straight-line depreciation is an easier method than other depreciation methods because it requires less record-keeping and calculation.

8000 1st Year Depreciation Expense. Purchase Price The total cost incurred to purchase the fixed asset PPE Salvage. It allows you to.

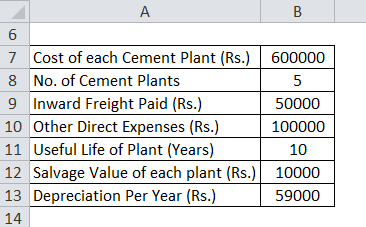

Free depreciation calculator using the straight line declining balance or sum. Web Under MACRS the deduction for depreciation is calculated by one of the following methods. Depreciation Per Year Cost of Asset Salvage Value Useful Life of Asset.

The final cost used in the depreciation calculation should include the base. 25000 x 30 7500. Web Formula to calculate Depreciation Per Year is as follows.

Web The formula follows. 1600 Final Year Depreciation Expense. Periodic straight line depreciation Asset cost - Salvage value.

Straight Line Depreciation Definition Formula Examples Video Lesson Transcript Study Com

1 Free Straight Line Depreciation Calculator Embroker

Straight Line Depreciation Formula How To Calculate

Depreciation Expense Straight Line Method W Example Journal Entries

Straight Line Depreciation Calculator Gantpmv

1 Free Straight Line Depreciation Calculator Embroker

Straight Line Depreciation Calculator

Straight Line Depreciation Method What Is It Formula

Straight Line Method Of Depreciation Accounting Youtube

Depreciation Accounting Straight Line Depreciation Method With Partial Period Allocation Youtube

Straight Line Depreciation Tables Double Entry Bookkeeping

How To Calculate Depreciation Straight Line Method Depreciation Youtube

Wbbse Solutions For Class 8 Maths Chapter 11 Percentage Wbbse Solutions

How To Calculate Straight Line Depreciation Formula

Depreciation Methods Principlesofaccounting Com

Is Depreciation Subtracted Twice On Balance Income Statements Quora

.png)

Solved List Any Errors You Can Find In The Follo Solutioninn